The economic calendar is massive, including the most important reports. Earnings season is in full swing. The FOMC is meeting. There is daily news about the impeachment investigation. And last, but certainly not least, there is continuing posturing about the US/China trade negotiations. So much to watch? How will the market react to this news avalanche?

Since I cannot possibly predict the answer, I will emphasize what to watch. This starts with the key question:

What are market expectations?

Complicating matters, we must answer this question on each of the several important news elements.

Last Week Recap

In my last installment of WTWA, I suggested that this earnings season, more than most, offered some shopping opportunities. The media did not really pick up this theme, but some traders and investors did. Veteran market observer Charles Kirk, in his subscription-only investment letter, took note of the unusual reactions:

I don't know about you, but I'm also seeing a lot of stranger than usual reactions to earnings. I've seen numerous stocks beat and raise guidance and the price then drops while I have seen others disappoint and lower guidance unexpectedly and then subsequently rally. I have also seen initial reactions fade - both positive in negative - in the days that follow making trying to game earnings even more challenging than usual.

This type of trading would be consistent with what I have been expecting.

The Story in One Chart

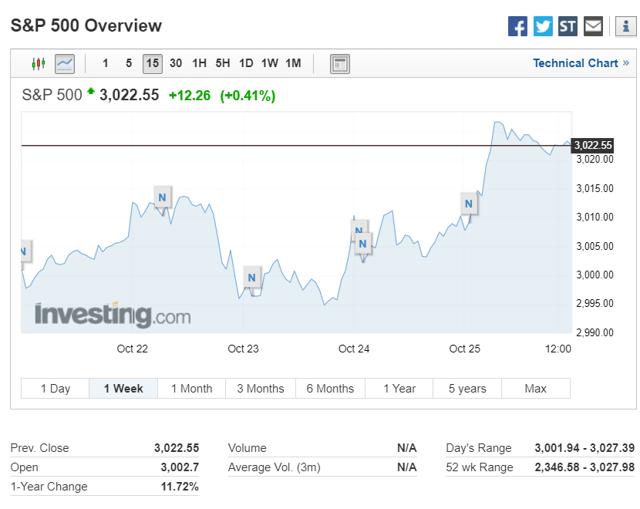

I always start my personal review of the week by looking at a great chart. This week I am featuring the Investing.com version.

The market gained 1.2% for the week with a narrow trading range, also 1.2%. You can monitor volatility, implied volatility, and historical comparisons in my weekly Indicator Snapshot in the Quant Corner below.

Noteworthy

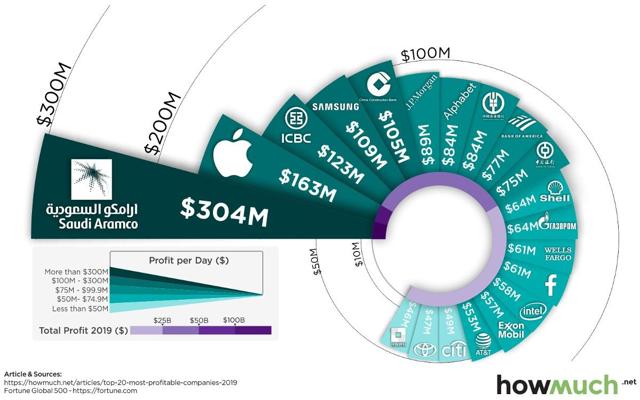

How many of the world’s 20 most profitable companies can you name? The Visual Capitalist has the answer.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

New Deal Democrat’s high frequency indicators are an important part of our regular research. The results remain very positive for the long term, and positive for coincident indicators. Short-term indicators have been volatile and have declined to a “neutral” rating. NDD is less concerned about a near-term recession.

The economic news items for the week were all close to expectations and well within the margin of error.

The Good

- Initial jobless claims were only 212K, lower than the prior week’s upwardly revised 218K and expectations of 217K.

- New home sales were in line with expectations, but this is “the best four month stretch since 2007.” (Calculated Risk)

The Bad

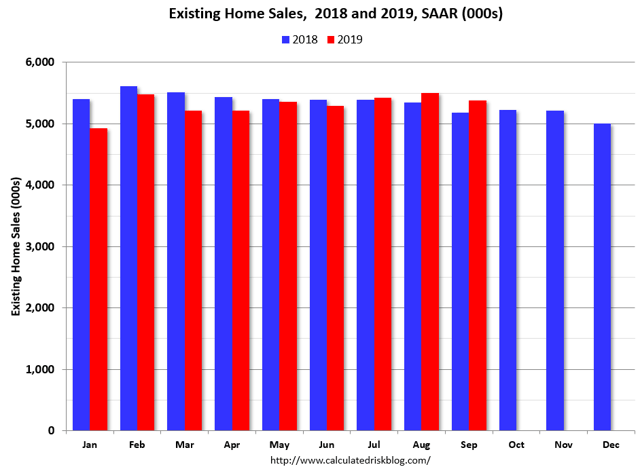

- Existing home sales for September registered 5.38M (SAAR) versus August’s 5.50M and expectations of 5.52M. Calculated Risk has a complete analysis including YoY (up 3.9%), low inventory, and the YTD lag of 1.7%. Bill expects improvement since the end-of-year comparisons for 2018 are easier.

- Mortgage applications continued the wild swings, down 11.9% for the week versus the prior change of 0.5%.

- Hotel occupancy for mid-October is down 0.9%. (Calculated Risk).

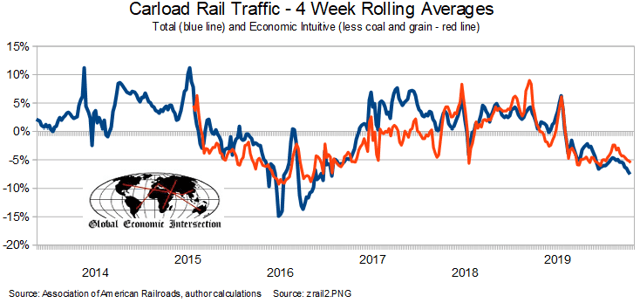

- Rail traffic worsens again. Steven Hansen (GEI) analyzes the weakness in the “economically intuitive” sectors.

- Michigan sentiment for October registered 95.5 close to the 95.8 expectation and down a bit from September’s 96.0.

The Ugly

Bankrupt farmers, encouraged by lenders just a few years ago, are now seeing the loans called. It is a poor time to be growing soybeans in Ohio. (Reuters)

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

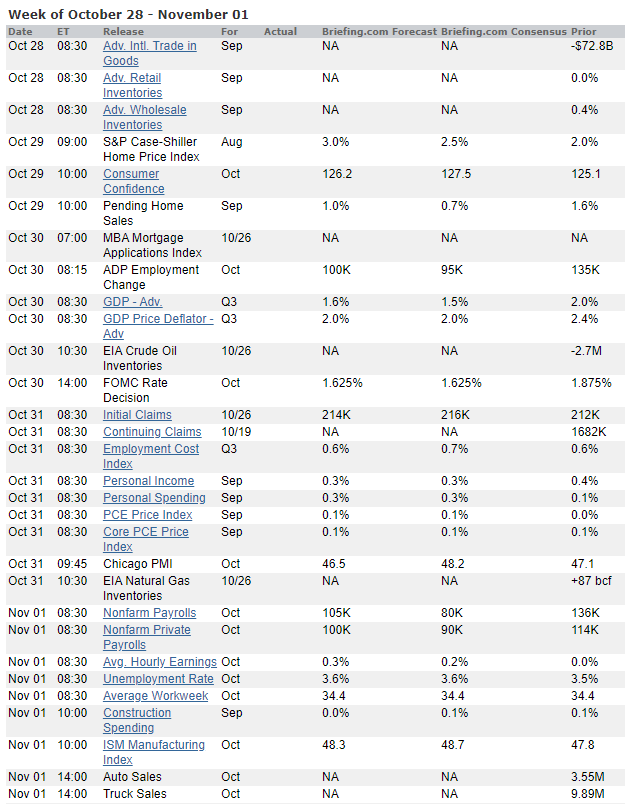

The economic calendar is massive, featuring employment news but including any other important reports. Many will focus on the FOMC meeting. We are also in the heart of earnings season. Who knows what will prove to be most important?

Briefing.com has a good U.S. economic calendar for the week. Here are the main U.S. releases.

Next Week’s Theme

The week ahead is jam-packed with fresh information -- important economic data, earnings reports, the FOMC meeting, and the continuing news from Washington. If you are interested in the possible market reaction you need an opinion about the data as well as a sense of market expectations. We are all consumers of data, not forecasters. Understanding expectations helps us be more informed consumers. For each of the news topics, we should be asking:

What are market expectations?

Background

This week’s question lends itself to an analytical framework that allows me to remain brief while still hitting the key points. Readers seem to like it. Comments are welcome.

|

Topic |

Market Expectation |

Jeff’s Guesstimate |

Upside/Downside |

Opportunity |

|

Employment |

< 100K net gain |

I’m concerned about effects of GM strike, perhaps as much as 75K jobs. |

Not a lot of upside from a good report. A big miss will be highlighted as economic danger. |

Since the “defining moment” will soon improve data, it is right to buy weakness. |

|

Other Econ Data |

Slow economic growth. |

Expectations have been accurate. Reliably bearish commentators emphasize that growth is slower. I see growth at about baseline levels. |

Plenty of negativity embedded in the market viewpoint. This is reflected in sentiment indicators, money flows, and Barron’s Big Money poll |

There is rarely such an economic opportunity. If/when the trade war eases, we will see the reverse of the real-time economics lesson. |

|

Earnings |

Modest growth beating a “low bar” of current expectations. Continued overall decline. |

My top sources show that the current beat rates exceed recent averages (FactSet) and that expected earnings estimates have resumed rising. (Brian Gilmartin). |

Earnings have been good enough to sustain the near-record market. There may be downside, but it is unlikely to come from earnings. |

The opportunities will come from stocks that miss based upon trade and currency factors. Watch The Transcript and Seeking Alpha. |

|

FOMC |

Another 25 bps and some dovish language. |

We’ll get the ease, but language will be tougher. |

There is a broad swath of market participants who interpret everything in terms of the Fed. Mostly, they missed the fundamental changes and grabbed onto the Fed explanation. |

Since hot money follows this theory, a hardening of Fed language is a likely short-term risk. Those of us with a longer view may get an opportunity. |

|

Trade Deal |

Market remains skeptical about an actual deal and also the effects. |

There is a significant difference in this announcement and those of the past. |

Navarro is still fighting the agreement but is apparently alone. |

This remains the greatest investment opportunity, evaluated skeptically by a range of pseudo-experts. |

|

Impeachment |

Market does not expect removal from office, and does not care about House actions. |

Investigation may drag out with new revelations possible. I don’t see it as a major market factor. |

Little market potential since impeachment is unlikely and GOP does not mind Pence. |

I see no opportunities based upon this news. |

|

Election |

Market expects Trump, prefers Biden among Dems. |

I have no basis for a sound prediction. |

The market is reacting to news about Dems. |

It is far too early to act based upon the election. |

I’ll have some additional observations in today’s Final Thought.

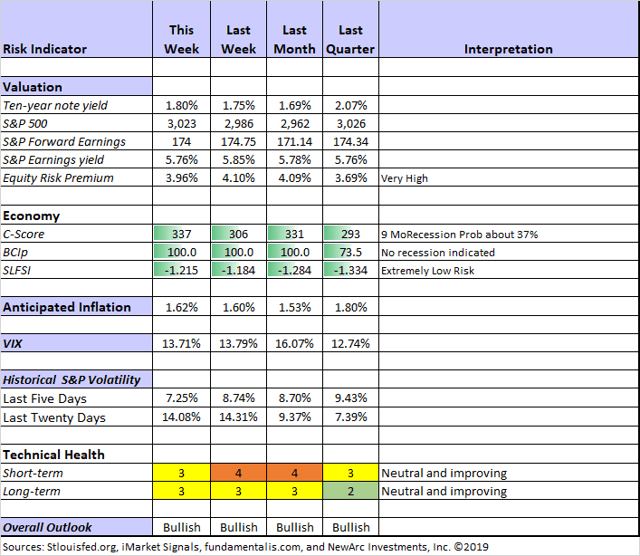

Quant Corner and Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update, featuring the Indicator Snapshot.

Short-term and long-term technicals have both improved significantly. Recession risk is still in the “watchful” area. We are seeing little confirmation for the risk signals, which we have been monitoring since May.

Considering all factors, my overall outlook for investors remains bullish.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score”.

Georg Vrba: Business cycle indicator and market timing tools. The most recent update of Georg’s business cycle index does not signal recession.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Doug Short and Jill Mislinski: Regular updating of an array of indicators. Great charts and analysis.

Guest Sources

Mark Rzepczynski is among those pondering the implications of the “uninverted” yield curve. He thinks that riskier positions are now justified. Other sources from my list of reliably bearish commentators insist that once the inversion occurs, our fate is sealed!

James Picerno asks, Is The Slowdown In US Manufacturing Stabilizing? He finds supporting evidence in the Federal Reserve Bank surveys.

I also continue my series on reviewing indicators on fattrader, this time focusing on several I do not find useful.

Insight for Traders

Our weekly “Stock Exchange” series is written for traders. I try to separate this from the regular investor advice in WTWA. There is often something interesting for investors, but keep in mind that the trades described are certainly not suitable for everyone. Last week we had a company conclave at mission control in Incline, Nevada. The views are beautiful, but the air is thin.

The models will resume their appearance soon with some new participation among the characters and the editorial team.

Insight for Investors

Investors should understand and embrace volatility. They should join my delight in a well-documented list of worries. As the worries are addressed or even resolved, the investor who looks beyond the obvious can collect handsomely

Best of the Week

If I had to recommend a single, must-read article for this week, it would be Validea’s excellent interview synopsis, Joel Greenblatt Defends Value Investing. Greenblatt emphasizes how his definition of value investing differs from most, “…assigning values to businesses based on their cash flow and expected cash flows and then trying to purchase them at a discount to what those streams are worth.”

Here is a key quote:

Greenblatt thinks most people should index because the majority is not very good at valuing businesses, “and they’re not very good at picking managers—another hard art—so they’re left between a rock and a hard place.” Valuing a business is difficult, Greenblatt explains: “Most people don’t have the ability to value a business at a discount and the discipline to hold them. When people can check their returns 30 times a minute on the internet, time horizons shrink, investors are impatient and sell at any sign of underperformance, so they fail to participate in periods of overperformance.”

To see more check out the WSJ for the original interview.

Stock Ideas

Beth Kindig updates her accurate Microsoft analysis with emphasis on the implications for cloud valuations.

Marc Gerstein turns his screening tools to the task of finding “unsung ETFs” to augment your portfolio.

Stone Fox Capital opines, Gilead Sciences’ Turnaround is Here.

Etsy, Inc. (ETSY) beating Amazon (AMZN). This is the surprising conclusion from Peter F. Way’s market-maker based comparative approach.

Want a diversified commercial property REIT with a 25-year record of increasing dividends? William Stamm recommends Realty Income (O).

Eddy Elfenbein reviews the positive tone of this earnings season with more detail on the stocks in his famous “buy list.” This discussion is a helpful guide to his ideas and may provide some sparks for you as well. Investors who want to own Eddy’s entire list can join me in buying the ETF tracking his holdings, CWS.

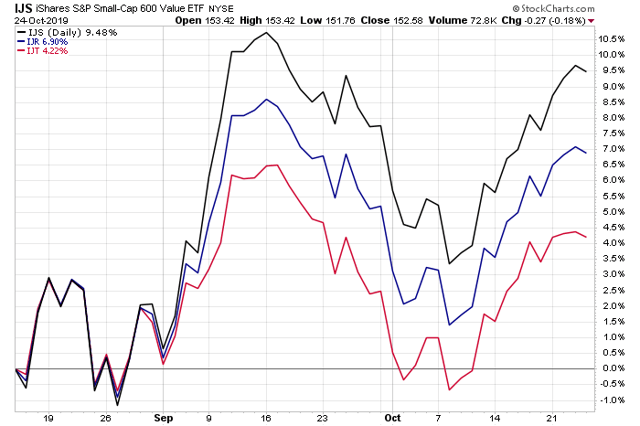

The Great Rotation

The Revival In The US Equity Value Factor Rolls On explains James Picerno.

He quotes Dimensional Fund Advisors as follows:

In a recent research note, DFA observes that “some of the weakest periods for value stocks when compared to growth stocks have been followed by some of the strongest,” as illustrated in a chart included the analysis (see below). “On March 31, 2000, growth stocks had outperformed value stocks in the US over the prior year, prior five years, prior 10 years, and prior 15 years. As of March 31, 2001—one year and one market swing later—value stocks had regained the advantage over every one of those periods.”

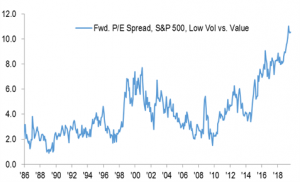

Daniel Lysik of Miller Value Partners highlights the crowded trade/value differential in his recent investor letter, Exceptional Value Opportunity Last Seen 20 Years Ago. There are many great points, but this evidence is striking:

While the marketplace has been cheering growth and low volatility securities, it has shown great disdain for the least expensive (value) securities in the marketplace. As value investors, we are attracted to the unloved, under-followed portion of the equity marketplace, where one is likely to find the greatest divergence between price and value. Many value securities’ market prices appear to be already discounting a lot of current market concerns, including a potential recession. But how inexpensive are Value stocks today? The price-to-earnings multiple for the value universe is in the low double digits, with the lowest valuation securities closer to 8x! The most expensive portion of the market has a P/E multiple that is 10x greater than the least expensive! As the chart below highlights, the price-to-earnings discount of value equities to the overall market is approaching 1999/2000 lows.

Personal Finance

Abnormal Returns is the go-to source for anyone serious about the investment business. The Wednesday edition has a special focus on personal finance, with plenty of ideas for the individual investor. As always there are many good links. I suspect that most readers will both enjoy and find useful 9 Myths About Credit Scores. Here is one tidbit: “…the truth is that closing an older credit card won’t help your score—and it might actually hurt you.”

Watch out for…

Buying a mutual fund right before a large, late-year capital gains distribution. For many, this is a tax trap. (WSJ).

Square (SQ). Ben Walsh (Barron’s) questions the premium multiple.

Final Thought

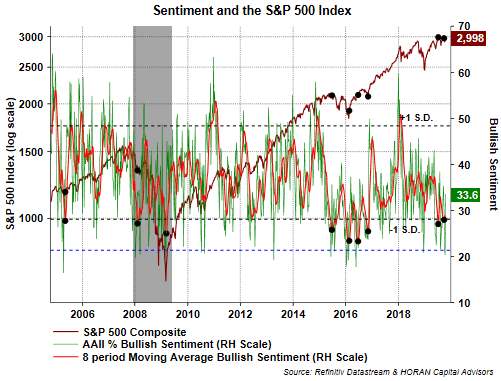

Fighting the negative headline flow is always a challenge for investors. Buying when others are fearful sounds great, but what if you are fearful yourself? A second challenge is identifying such times. I am often asked how sentiment can be negative with markets near record highs.

- Sentiment should be evaluated by behavioral factors, not the current market level;

- Market prices can reflect the crowded trades of fear stocks and momentum, leaving plenty of cheap sectors;

- And most importantly, a bull market continually makes new highs. Fear is the fuel.

- In the absence of fear, stock prices would be much higher – and it would be time for some selling.

David Templeton (HORAN) captures the concept nicely, reviewing several different sentiment indicators—put/call ratio, AAII sentiment, and equity fund flows. Here is one of the several helpful charts.

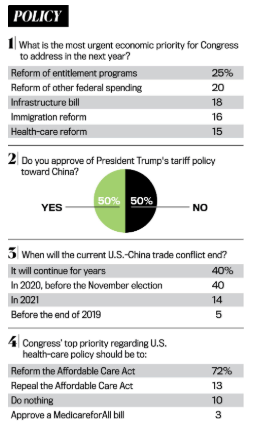

Barron’s cover story summarizes the negative attitudes of those in their regular “Big Money” poll. They see the market as over-valued, and fear a Democratic election victory – particularly Sen. Warren. Only 27% are bullish on stocks. “Respondents frequently cited trade policy as a lingering worry and damper on stock performance.” Here is the list of policy concerns:

See the full article for more findings and charts.

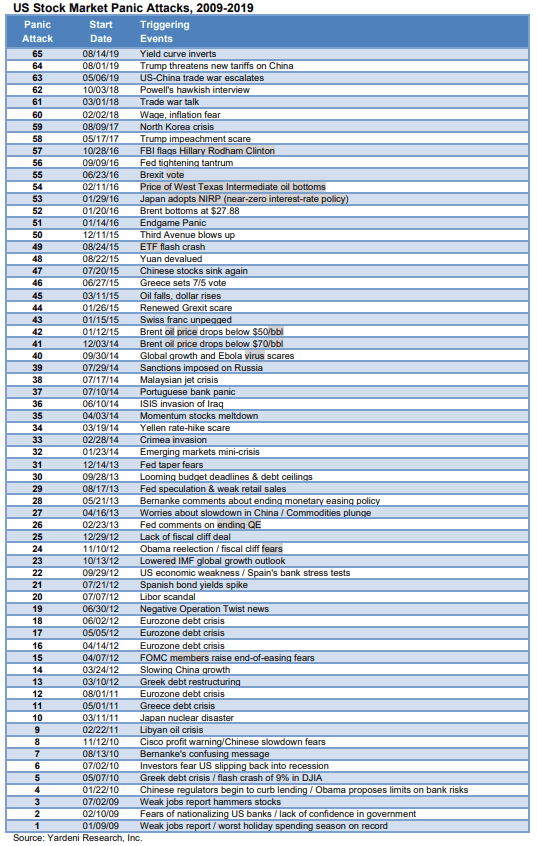

And finally, Dr. Ed Yardeni has a book of charts showing the “panic attacks” from 2009-19. The charts are more fun, but the list may inspire readers to check out the full report.

The “Big Money” is not always the “Smart Money.”

Institutional investors get especially worried about performance near year’s end. The individual investor need not mark returns in twelve-month increments!

[In this time of special opportunity, are you finding the real bargains? Do you hold ETFs that are loaded up with over-valued stocks? A little homework will help you find the cheap alternatives. Write for my free sector spotlight paper on housing, currently my favorite sector. You will get some ideas about replacing over-valued stocks with those showing great potential. Or you might find the homework no more attractive than painting your house. Just send an email request to info at inclineia dot com].

Some other items on my radar

I’m more worried about:

- Escalating revolutionary activity.

- Brexit – still.

I’m less worried about

-

Trade negotiations. The signs, even the posturing, are all consistent with progress.

-

Mrs. OldProf says that I should be less worried about her Packers. OK, check.

Disclosure: I am/we are long GILD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

2019-10-27 06:43:28Z

https://seekingalpha.com/article/4299408-weighing-week-ahead-analyzing-market-expectations

Read Next >>>>

Bagikan Berita Ini

0 Response to "Weighing The Week Ahead: Analyzing Market Expectations - Seeking Alpha"

Post a Comment