A NYSE stock specialist (Photo credit - STAN HONDA/AFP via Getty Images)

AFP via Getty ImagesThink we are in a rising market? Well, just search for “bear market” and you will find many stocks that the gurus say are currently in bear markets. How do they do it? What do they see that we don’t?

That’s the purpose of this write-up – to provide the way that you, too, can impress others by saying, “Hey, that’s in a bear market!”

Step 1 – Get the technology

- Hardware: A computer (sorry, your phone won’t do)

- Internet connection: Some way to get to the web

Step 2 – Identify the data collection and management service provider

- My preferred choice is Financial Visualizations (FinViz.com) that has all exchange listed stock and fund data (fundamental and technical) that can be screened and sorted

Step 3 – Memorize this key “fact”

- If the market or a stock is down 20% or more from its high, it is in a bear market

You’re ready, so let’s take a test run…

- Fire up your computer and get onto the Internet.

- Open FinViz.com, and click on “Screener”

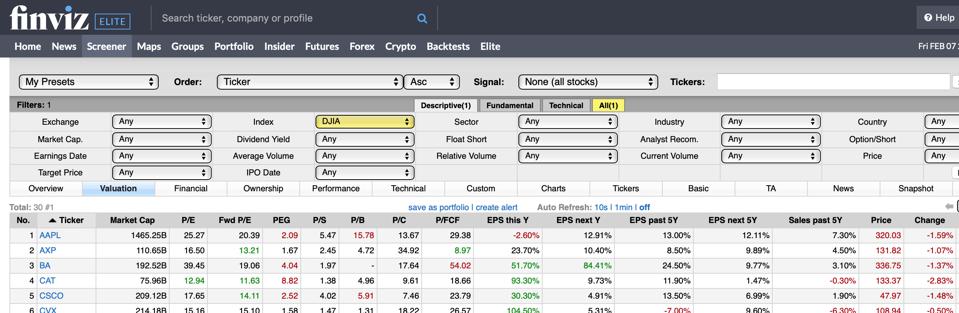

- At “Index,” click on DJIA (Dow Jones Industrial Average) – I know you knew that, but for the others…

This is what you should see:

FinViz.com - Screenshot #1

John Tobey (FinViz.com)Now for a two-step procedure to find stocks in bear markets:

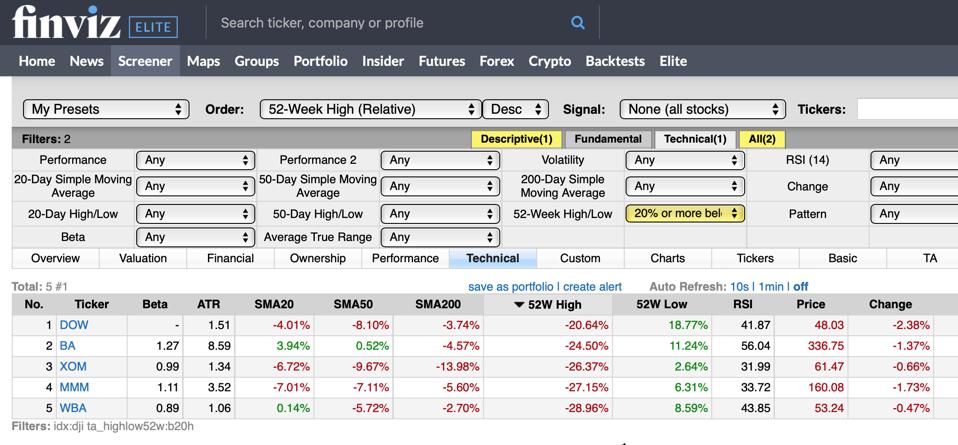

- Click on the “Technical” tab near the top out within the four-tab set: Descriptive / Fundamental / Technical / All

- Click on 52-Week High/Low button (“Any”) and choose “20% or more below High”

Congratulations! You have found the DJIA stocks that are currently in a bear market… or not (more about that “or not” later)

- Now click on the “Technical” tab below so that the technical indicators are shown. Here is how the report looks as of the February 7, 2020, close. (Clicking on a column title sorts by that item.)

FinViz.com - Screenshot #2

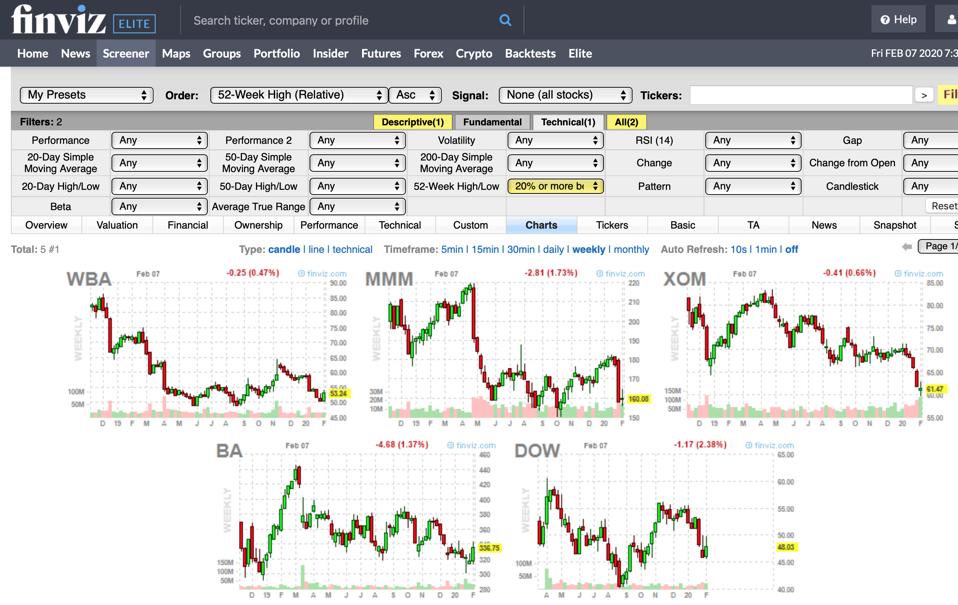

John Tobey (FinViz.com)To see how these stocks got to their sorry state, click on the “Charts” tab, then click on “Candle” for Type and “Weekly” for Timeframe. Here is the result, with the charts covering the past 52 weeks.

FinViz.com - Screenshot #3

John Tobey (FinViz.com)Great! But, wait –

We need to go back to the “or not” I mentioned

Before telling someone about the five bear market stocks, we need to discuss a serious issue: The real definition of “bear market.”

Investopedia has the “modern” definition:

“What Is a Bear Market?

“A bear market is a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment. Typically, bear markets are associated with declines in an overall market or index like the S&P 500, but individual securities or commodities can be considered to be in a bear market if they experience a decline of 20% or more over a sustained period of time - typically two months or more.”

This definition reflects what we read frequently. So, what’s wrong with it? Three issues:

- It substitutes simplistic numerical categorization for complex qualitative insight. True understanding of a bear market requires analysis and evaluation of the “widespread pessimism and negative investor sentiment” that the terms, “bear” and “bearish,” represent.

- No two bear markets are the same, and that goes especially for the size of the drop. Some have been less than 20%, and others much more.

- The inclusion of individual securities is now widespread, and that is nonsensical and highly misleading. Look at those five DJIA stocks we found above. Sure, they are in the stock market, but they are not the market. As so often happens in the stock market, stuff happens to individual companies (think Boeing). Is the stock down because of widespread pessimism? No, it’s down because the company’s outlook has deteriorated. In other words, Realism, not emotions, caused the drop. This mis-categorization has gotten so pervasive that it caused Barron’s

2020-02-08 06:18:22Z

https://www.forbes.com/sites/johntobey/2020/02/08/how-to-be-an-expert-at-spotting-bear-market-stocks/

Read Next >>>>

Bagikan Berita Ini

0 Response to "How To Be An Expert At Spotting Bear Market Stocks - Forbes"

Post a Comment