The past couple of weeks have been the most insane period many investors have ever witnessed. Fears over the health and economic impacts of COVID-19 has caused more days of extreme volatility in the past few weeks than in the past few years. Any one of about a half-dozen days over the past two weeks would qualify as either the single best, or single worst, day for stocks in at least a decade.

How crazy has it been? On Thursday, March 12, both the S&P 500 and Dow Jones Industrials fell 10%, the worst day for stocks in more than 32 years. On Friday, the markets rebounded late in the day to gain 9%, one of the best days for stocks in decades, but stocks still fell more than 10% on the week and are still down 20% from the 2020 peak.

Image source: Getty Images.

Early steps to arrest the spread could be too little too late

The U.S. has banned travel from Europe and is adding the UK and Ireland on Monday. The travel, entertainment, and sports industries have practically shut down. Millions of people are already under quarantine and "social distancing" to prevent exposure, and the U.S. is at risk of seeing an explosion in the number of COVID-19 cases. Sadly, that's my expectation; things probably will get worse for the global economy. Despite aggressive actions to reduce transmission, COVID-19 cases in the United States are almost certain to increase -- and potentially at exponential rates -- in the next few weeks.

If that happens, our critical care capacity will be stretched beyond its capacity and the U.S. death toll will skyrocket. More businesses will close their doors and people will be far more afraid than they already are. Markets will plummet further.

Image source: Getty Images.

But I think it's time to buy (some) stocks

So why am I saying "it's going to get worse" while also saying "it's time to buy"? They're not mutually exclusive ideas. Market history says it's better to take advantage of double-digit drops when they happen than try to be too precise and catch the market at the absolute bottom. Despite the risk of a further decline, the probability that the market may not fall much further is why I've already started buying, deploying about half the spare cash I've kept in reserve over the past couple of weeks.

Historically, we get a 10% market drop every two years on average, and since 1950 stocks have fallen 20% or more only 10 (11 now) times, about once every six years. Declines of 30% or more have happened only five times. Waiting for 20% or 30% drops before investing isn't a winning plan because stocks almost always gain far more than they fall between those occurrences.

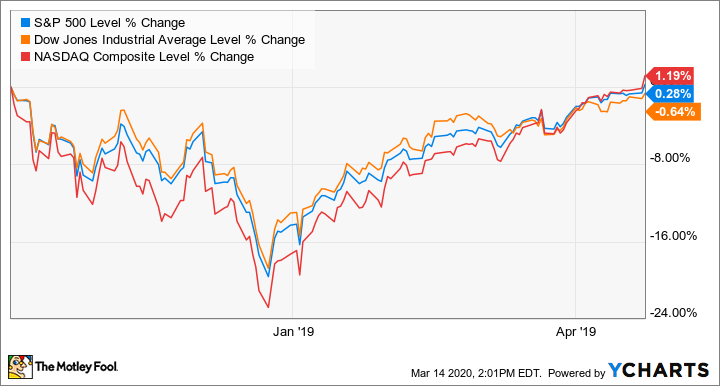

Plus, the market usually recovers more quickly than people expect. The S&P 500 fell 20% from Oct. 1 to Dec. 24 in 2018, but fully recovered by April 2019:

Many people don't even remember that this happened -- and was what set up 2019 to be such a great year for stocks, with the market gaining 30%.

Add it all up, and history says the best move is to buy now, and certainly not sell. This is the time to circle the wagons on your existing investments, while looking to deploy extra cash methodically into the best stocks that are now selling a big discounts.

The kinds of stocks that investors should be looking for now

Stocks across industries have fallen sharply. Ford (NYSE:F) and Live Nation Entertainment (NYSE:LYV) have lost over 40% of their value. No surprise, as Live Nation, one of the world's largest event promoters, has already suspended all tours through at least the end of March and could extend that for many months to come. Ford faces a potential recession and demand for automobiles around the world could plummet. They've already fallen 80% in China. Even companies like Brookfield Renewable Partners (NYSE:BEP), a renewable energy producer that's about as recession-resistant a business as exists, has lost 25% of its value during the crash:

Let's talk about why Ford, Live Nation, and Brookfield Renewable should be on your list to buy.

Ford and Live Nation will almost certainly suffer from weak results in the quarters ahead, but both have strong balance sheets that enable them to ride things out. And when we look out a year or two or five, it's really hard to imagine a scenario where both aren't just as relevant -- and profitable -- as they were before coronavirus.

For Brookfield, this is the sort of business investors should want to own during a market crash. It produces and sells renewable energy to utilities all around the world, and even with industrial consumption on track to fall, electricity is not something people skip out on or delay, like a concert or a new vehicle.

Sure, they could fall even more -- Ford and Live Nation in particular -- as things play out. But when you treat stock ownership appropriately -- owning for many years and even decades -- you will have set yourself up for bigger and stronger returns when things return to normal. Which they will. We just don't know when that will be.

The reason it's hard to buy right now

Watching the value of your portfolio plummett so far over such a short period of time hurts -- and not just metaphorically. According to scientific studies, your brain responds to financial losses in the same way it responds to physical pain. This explains why people sell during periods of uncertainty. Losing hurts, and people act quickly to avoid further pain.

It's hard to see past the current risk to the future rewards. Image source: Getty Images.

The opposite side of the psychological coin explains why it can be so hard to buy right now. As much as it hurts to lose, the pleasure we gain from a winning investment doesn't feel as good as the pain from losing hurts. Your brain is telling you "it's going to get worse. Get out now and stay out," in an effort to avoid further suffering.

This is an evolved response that's baked into our DNA. It kept our ancestors from getting eaten by predators or poisoned by eating unknown berries millennia ago, and it has played a huge role in the survival of our species for millennia.

The problem is it doesn't work to our advantage as investors in market crashes. Looking objectively at stocks that have crashed by so much, and in some cases seeing our own portfolios down even more, is difficult when our brain chemistry is literally pushing us to get away from this dangerous thing that's already caused us much harm.

Doing what's worked in the past: Buy stocks when the market crashes

I want to use a few charts to visually represent past market crashes, and apply the context of longer periods of time to them. Let's start with the 2007-2009 crash:

Stocks have fallen less than half that much, but it feels essentially just as painful, despite having caused far less financial damage thus far. That's because our brains are wired to push us away from perceived threats.

Now let's take a look at how the market has done from that 2007 peak through market close on Friday:

That massive drop sure looks a lot smaller from here, doesn't it? Less painful with the fuller context of the market's recovery and continued march higher. Sure, nobody could have predicted the unprecedented 11-year bull run since the 2009 bottom, but that's not unique. Nobody predicted any other bull runs before they happened, either, just as nobody predicted a pandemic would cause the current crash.

One more chart for the ultimate in perspective on why this is exactly the best time to buy stocks:

The S&P 500 has gained in value, an average of about 7% per year in compounded annual returns. Add in the dividends and it jumps to 10% annually. That's across bull and bear markets, oil shortages, wars, and global recessions. But inexorably, things return to normal, businesses get back to doing what they do best, and markets go up. Just because this time feels different, doesn't mean it's going to be different. Life will return to normal just as it always does; hopefully society will have learned lessons about caring for one another and practices to reduce the threat of another global pandemic.

The one lesson I hope some of you take away from this is that, just by looking at the chart above, there's clearly a best time to buy stocks. That's right. When the market was crashing and it seemed like it would only get worse. Now is one of those times, despite -- maybe because -- everything your brain is telling you.

2020-03-15 10:01:00Z

https://www.fool.com/investing/2020/03/15/should-you-buy-stocks-when-the-market-crashes.aspx

Read Next >>>>

Bagikan Berita Ini

0 Response to "Should You Buy Stocks When the Market Crashes? - Motley Fool"

Post a Comment